More resources for enterprises to overcome the pandemic

|

2% value added tax discount on various groups of goods and services

According to the Ministry of Finance, in 2020-2021, due to the impact of the Covid-19 pandemic, businesses faced many difficulties; the economy faced many challenges in terms of macroeconomic stability; increased input costs; broken supply chains...

Many support policies, including solutions on tax exemption and reduction, have been issued and implemented, with positive results, focusing on industries and fields where businesses and people are heavily, directly affected by the Covid-19 pandemic. These above solutions are assessed as timely, have a positive impact and are highly appreciated by the business community and people, contributing to solving difficulties, stabilizing production and business activities as well as increasing growth in 2020 and 2021.

However, in the face of the far-reaching consequences of the Covid-19 pandemic, it is necessary to have comprehensive solutions and policies to quickly support socio-economic recovery and development, meeting the requirements of implementing the projected goals. Therefore, the Government developed and submitted to the National Assembly at the first extraordinary session, the XV National Assembly passed Resolution No. 43/2022/QH15 on fiscal and monetary policies to support the Socio-economic recovery and development program. In particular, the resolution stipulates a number of tax exemption and reduction policies, such as value-added tax (VAT) reduction, allowing to be included in deductible expenses in corporate income tax (CIT) taxable income.

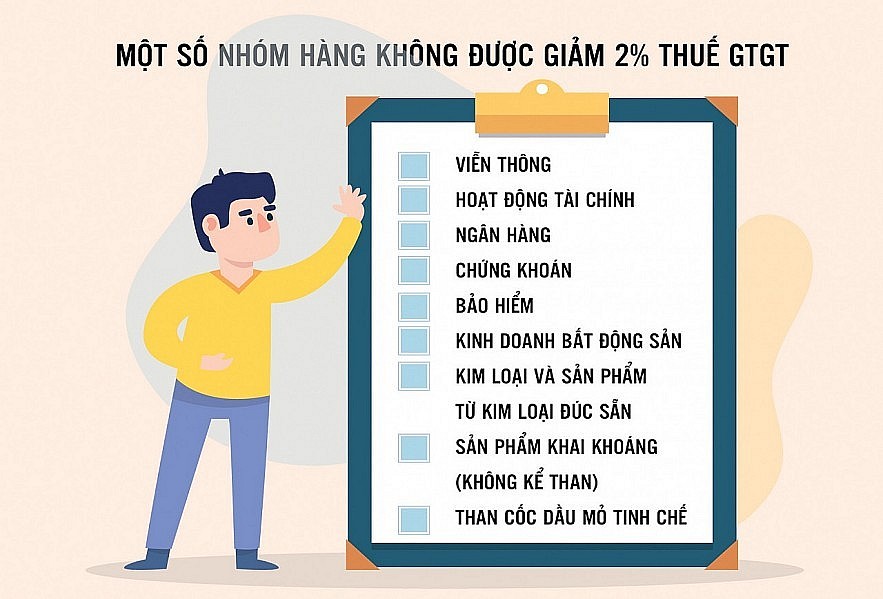

The Ministry of Finance submits to the Government a number of provisions in the draft decree. 2% reduction of VAT, applicable to groups of goods and services currently subject to the 10% tax rate (down to 8%) from the effective date of this Decree to the end of December 31, 2022 (except for some groups of goods and services).

Regarding the determination of goods and services those are subject to the 10% VAT rate but ineligible for VAT reduction: Resolution No. 43/2022/QH15 of the National Assembly stipulates the group of goods and services that is ineligible for VAT reduction but has not been specified. For the application convenience of organizations, individuals and tax administration agencies, and at the same time to ensure consistency and synchronization with the current specialized legal system, the identification of goods and services ineligible for VAT reduction is implemented in accordance with the appendices issued together with this Decree. This list of goods and services is determined based on goods and services subject to excise tax (ET) in the current Law on ET.

Strict supervision for an effective support package

Regarding the subjects of application, in Resolution No. 43 of the National Assembly, it was stipulated to reduce VAT for groups of goods and services subject to the 10% VAT rate (regardless of goods suppliers, services are enterprises, organizations or business households, business individuals). Therefore, the Ministry of Finance proposes to apply VAT reduction to organizations and individuals producing and trading goods and services subject to 10% VAT, regardless of the tax calculation method of business establishments: credit and percentage method of sales.

The draft decree also clearly guides the implementation of deductible expenses when determining CIT taxable income for support and sponsorship expenditures of businesses and organizations for Covid-19 pandemic prevention and control activities in Vietnam.

Enterprises and organizations that are taxpayers of CIT according to the provisions of the Law on CIT, in the CIT period of 2022, are included in deductible expenses when determining taxable income for donations and sponsorships in cash and in kind for Covid-19 pandemic prevention and control activities in Vietnam through the units that receive donations and sponsorships specified in Clause 2 of this Article.

In order to create favorable conditions for businesses and people to soon enjoy tax reduction policies, facilitate the issuance of invoices as well as tax declaration and payment, and uniform implementation nationwide, this decree is expected to take effect from February 1, 2022.

According to National Assembly delegate Tran Van Lam - Standing member of the Finance and Budget Committee of the National Assembly, over the past time, fiscal policy has been conducted flexibly and effectively, major financial balances still weather the storm.

Regarding the support package, according to Mr. Tran Van Lam, in the current context, the problem of supporting businesses and stimulating growth, fiscal tools are the most important, in which tax policies also need to be flexible. He also concerns about waste and loss in the implementation of the fiscal and monetary support program, as such a strict monitoring mechanism is required for the support package to be effective.

| Expected budget revenue decrease is about 51.4 trillion dong Assessing the impact on state budget revenue, according to the Ministry of Finance, the decree specifically stipulates policy contents that have been decided by the National Assembly, so the scope of impact from support provisions in this draft decree is included in the draft content submitted to the National Assembly. Accordingly, it is expected to have the impact of reducing state budget revenue in 2022 by about VND 51.4 trillion. In which, the policy of reducing VAT is about VND 49.4 trillion; Expenses deductible for support and sponsorship of businesses and organizations for Covid-19 prevention and control activities is about VND 2 trillion. In order to overcome and offset impacts on state budget revenue in the short term as well as ensure the initiative in managing state budget estimates, the Ministry of Finance will coordinate with relevant ministries, branches and localities to focus on directing effective implementation and implementation of tax laws. At the same time, the collection agency drastically reduced the management of state budget revenue, focusing on timely and effective implementation of groups of solutions for revenue management, combating revenue loss, transfer pricing, and tax evasion. |

by Minh Anh

URL: https://thoibaotaichinhvietnam.vn/more-resources-for-enterprises-to-overcome-the-pandemic-99444.html

Print© Thời báo Tài chính Việt Nam