|

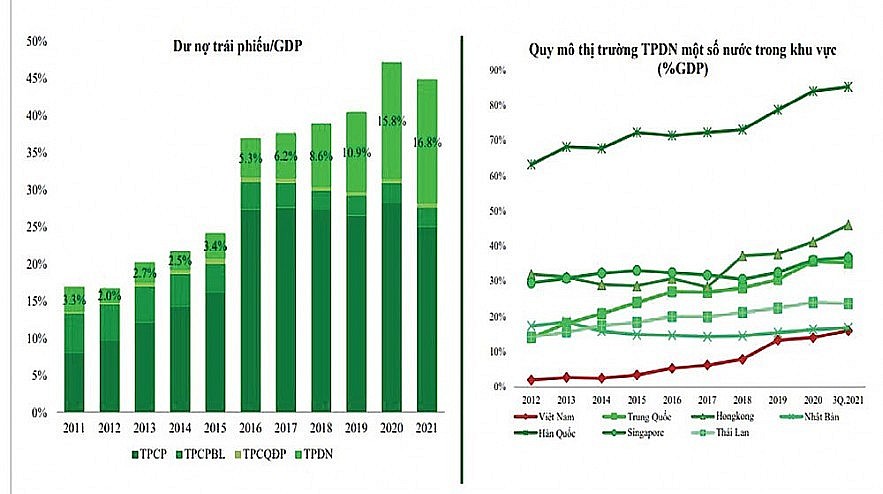

| Bond volume/GDP Bond market size of some regional countries (%GDP) |

Plenty of favorable factors in 2022

The corporate bond market in 2021 will continue to show excitement, even if it doesn't reduce the "heat" compared to 2020. According to statistics of Bao Viet Securities Company (BVSC), the total issuance value of corporate bonds in 2021 reached the highest level in history, over 650 trillion VND, an increase of about 40% compared to the amount issued in 2020.

According to experts, the corporate bond market in 2022 still has a lot of room for growth, but there will certainly be a purification in the direction of increasing the quality of issuers.

Ms. Hoang Thi Minh Huyen - Macro Analyst of BVSC said that in 2022, the corporate bond market still has many favorable factors to support development. Specifically: The reopening of the economy in 2022 will be the driving force behind the expansion of investment needs of businesses, thereby leading to a sharp increase in capital demand. The estimated maturity amount of corporate bonds in 2022 is over VND 200 trillion, 30% higher than the maturity amount in 2021, and also the highest maturity level ever; interest rates in 2022 will remain low, which will continue to make the corporate bond market attractive to investors, with higher yields.

Commenting on 2022, Securities Company, Bank for Foreign Trade of Vietnam (VCBS) also said that the corporate bond market is forecast to continue to have development steps with the expansion in both the size and diversity of the corporate bond product. “The growth potential exists in the long-term considering the growth of the economy comes with the business expansion needs of enterprises, which leads to the need for capital. At the same time, a favorable factor for the corporate bond market in 2022 is the low maintenance interest rate, "- VCBS experts said.

Ensuring sustainable development

According to VCBS experts, in recent years, management and supervision agencies have focused on the development of policy documents, closely monitoring the implementation process is also a plus point for sustainable development of the corporate bond market. Specifically, the last months of 2021 also recorded continuous compliance monitoring activities for Decree 153/2020/ND-CP, typically regulations related to professional securities investors.

VCBS experts expect the market's information transparency will continue to improve along with the compliance with the legal corridor to ensure sustainable development.

In line with the statement, the corporate bond market in 2022 may be less exciting, but will increase quality and transparency, Huyen said that the market shall be under stricter regulations from authorities and the completion of the legal framework for issuance and trading. However, "these will be the factors that help the corporate bond market develop healthier, but this will also somewhat slow down the bond issuance speed of some businesses in 2022" - BVSC's expert said.

From mid-January 2022, Circular 16/2021/TT-NHNN officially took effect, regulating the purchase and sale of corporate bonds by credit institutions and foreign bank branches. At the same time, from the beginning of December 2021, the Ministry of Finance has also sent an official dispatch to collect comments on the Draft Decree amending Decree 153. “We assess that these new regulations will affect the corporate bond market in 2022. Especially at the early stage when these documents take effect because businesses need time to adapt to the new regulations. This situation has also happened, like in September 2020, when Decree 81/2020 took effect, the issuance of corporate bonds decreased sharply in the following months. Or at the beginning of 2021, when the changes of many legal documents took effect, the issuance of corporate bonds in the following months also decreased. However, the corporate bond market has regained its pace in the later time, when businesses have adapted to the new regulations, "- analyzed Ms. Hoang Thi Minh Huyen.