|

| Corporate bonds worth 26,400 billion VND issued under Decree 08/2023/ND-CP |

This is encouraging news about the corporate bond market's recovery signal, which was recently announced by Deputy Minister of Finance (MoF) Nguyen Duc Chi at a Government Portal seminar on the afternoon of May 28 with the theme "Macroeconomic stability and development of the corporate bond market."

A lot of positive signs of recovery in the corporate bond market

Commenting on the recent difficulties in the corporate bond market, Deputy Minister Nguyen Duc Chi stated that it is due to a variety of factors, including the objective cause of the impact of the challenging situation of the world economy and Vietnam, greatly affecting production and business activities.

Furthermore, Vietnam's corporate bond market is rather young. So are the market participants, issuers, investors, and state management agencies.

Deputy Minister Nguyen Duc Chi emphasized several important solutions to revive the corporate bond market based on an analysis of the causes of market difficulties.

The first solution is to maintain macroeconomic stability, including stable interest rates, exchange rates, and inflationary pressures. That is the pivot for businesses to continue to function well and gradually return to the development track.

Second, direct legal provisions for this market are required so that it can act flexibly and effectively, responding quickly to practical developments. According to Deputy Minister Nguyen Duc Chi, the Government has recently issued many policies to address the market's issues. In particular, the Government quickly issued Decree No. 65/2022/ND-CP and Decree No. 08/2023/ND-CP. Such legal regulations have timely assisted issuers, conditional investors, and legal tools in resolving immediate difficulties in terms of cash flow, liquidity, collateral, etc., based on the principle of harmonious benefits and shared risks.

"Issuers must shoulder responsibility for their obligations, such as commitments to investors. The State shall supervise enterprises and the market to ensure that tasks are completed under the provisions of the law. Investors themselves must also follow the law so that the State can transparently support and monitor this market and ensure harmony of interests and interests of the parties", said the Deputy Minister.

In addition to legal removal, the Government has had other solutions to support production and business activities, such as policies on the exemption, relaxation, reduction of taxes, fees, and charges, debt restructuring for businesses, reducing interest rates, and removing barriers to the real estate market. All of these synchronous solutions not only benefit businesses but also have a positive impact on the corporate bond market.

Authorities, on the other hand, have strengthened supervision, inspection, and inspection to ensure that the market is transparent and adheres to legal requirements. The clear message from the Government is that economic relations will not be criminalized. According to the provisions of the law, businesses must respect the agreements of the issuers with investors and enforce their responsibilities, as confirmed by Deputy Minister Nguyen Duc Chi.

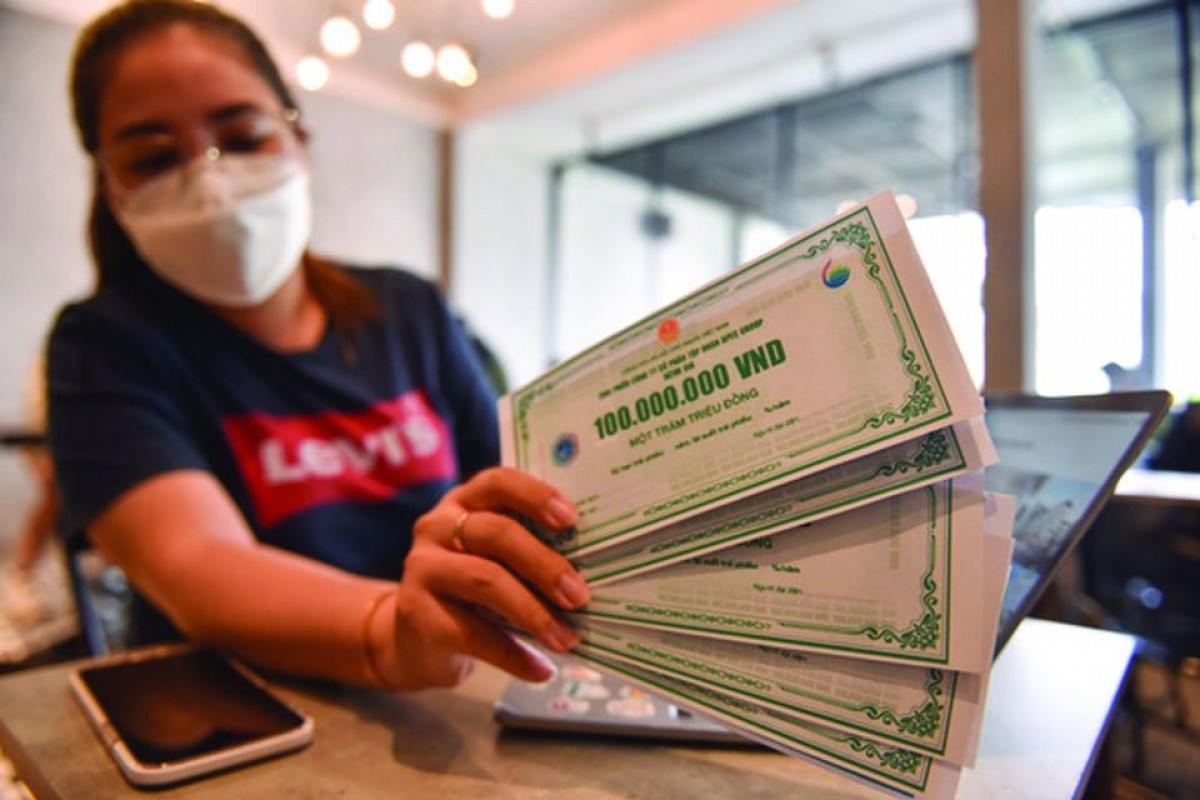

Deputy Minister Nguyen Duc Chi recently shared some results regarding the corporate bond market. He stated that since the issuance of Decree 08 on March 5, 2023, 15 businesses have issued 26.4 trillion VND worth of corporate bonds to the market. On the other hand, at the end of 2022 and during the first 2 months of 2023, almost no businesses were able to issue bonds to the market. This is a positive sign that the impact of the policy is encouraging businesses and investors to return to the market.

| According to a Stock Exchange report, 16 enterprises are successfully negotiating a bond volume of nearly 8 trillion VND (7.9 trillion VND in particular). Bulova Real Estate Group, Hoang Anh Gia Lai Joint Stock Company, Hung Thinh Land Joint Stock Company, and others are among the large issuers. Businesses and investors have successfully completed tasks such as negotiation, extension, asset conversion, and so on, thanks to new Government regulations. |

Moreover, since the implementation of Decree 08, a lot of businesses have successfully negotiated with investors to overcome obstacles in the liquidity process and cash flow when bonds are due.

According to the Deputy Minister, following these decrees, market participants' awareness and understanding of their responsibilities and obligations once participating in the market have greatly improved. Issuers and service providers strictly adhere to the regime of providing investor information. As a result of the new Government regulations, we have seen extremely positive initial results. The market is expected to adjust and begin to sustainably rise shortly.

Laying the groundwork for a sound financial system is a matter of urgency

Joining online from Singapore, Assoc. Prof. Dr.Vu Minh Khuong, a lecturer at the Lee Kuan Yew School of Public Policy, evaluated the policy response, saying that the Government has always stood by businesses to help them overcome the challenges they are currently facing in the corporate bond market.

In the long run, he emphasized the importance of laying a solid foundation for the market, as this is a critical channel for capital mobilization. Bonds play a very important role in countries that have created miraculous developments, accounting for up to 100% of GDP, which includes approximately 50% of businesses and 50% of the Government.

Based on recent market data, Assoc. Prof. Dr. Vu Minh Khuong demonstrated that the issuance interest rate is too high, reaching up to 13%, thus causing difficulties for businesses. It is more challenging if the leverage is too high, i.e., most rely on bonds, so it is necessary to carefully survey and assist the business.

| Communication, as mentioned by the Deputy Minister of Finance, is a crucial solution for the corporate bond market. For more than a year, communication on corporate bonds in particular, and policies in general, has yielded numerous impressive results. It helps raise awareness of all market participants, including issuers, investors, service providers, and even state management agencies, and then leads to a more complete and accurate understanding of this market. Since then, there has been a greater sense of fulfilling responsibilities and obligations following the law. |

Assoc.Prof.Dr. Vu Minh Khuong outlined three lines of defense to help businesses avoid criminal problems. The first line of defense is for business leaders to thoroughly understand corporate governance. The second line of defense is to ensure legal issues and rescue response. The third line of defense is the requirement for annual audits to assess. The economic situation is changing so quickly that recommendations must be updated on a regular and continuous basis.

Some countries do not prioritize investing in improving the bond ecosystem, making it difficult to develop. For example, Indonesia and the Philippines remain at the $30 billion issuance level. In the meanwhile, businesses in South Korea can issue trillions of US dollars, as Vu Minh Khuong pointed out.

From these facts, Prof. Dr. Vu Minh Khuong stated that laying the groundwork for a sound financial system for Vietnam's future is a critical priority. "I believe the Government this term is capable of doing so, and we will regard the current challenge as a strategic determination for Vietnam to lay a solid foundation for the future," said Vu Minh Khuong./.