|

The deficit decreased by 37.7% compared to the estimate

On the morning of May 12th, the Standing Committee of the National Assembly commented on the state budget settlement report for 2021. According to the Government report presented by Finance Minister Ho Duc Phoc, the state budget revenue estimate for 2021 is VND 1,358,084 billion; settled VND 1,591,411 billion, an increase of 17.2% over the estimate. In 2021, the proportion of state budget revenue encouragement reached 18.7% of GDP, with tax and fee collection accounting for 15.1% of GDP. Budget revenues increased primarily as a result of increased revenue from housing, lottery, and other budget revenues; crude oil production and prices sharply climbed; and import and export activities dramatically grew up.

| Interest debt payments went down as a result of the issuance of bonds in accordance with the budget revenue and expenditure schedules. Interest debt payment in 2021 settled at VND 101,778 billion, down by VND 8,287 billion (equivalent to 7.5%) from the estimate, owing primarily to the issuance of Government bonds in 2020 following the budget revenue schedule and the disbursement of investment capital, resulting in a lower loan balance at the end of 2020 compared to the expected 2021 estimate, combined with lower issuance interest rates than expected. |

Following the Party's policy, resolutions of the National Assembly, and Standing Committee of the National Assembly, in 2021, the Government has exempted and reduced tax obligations and some budget revenues, thereby helping businesses, business households, and people overcome difficulties and recover production and business activities, which are highly appreciated by the public. The total amount of tax, fees, and land rent that has been exempted, reduced, or extended is VND 132,418 billion VND.

In terms of expenditure, the estimate is VND 1,701,713 billion; the settlement amount is VND 1,708,088 billion, a VND 6,375 billion (equivalent to 0.4%) increase over the estimate. Recurrent expenditures settled VND 1,061,316 billion, an increase of VND 12,141 billion compared to the estimate. The State budget allocated VND 97,903 billion in 2021 to Covid-19 control and prevention, as well as assistance to people affected by the pandemic. Recurrent expenses make up 62.4% of the state budget's total expenditure, excluding costs incurred to establish a source for salary reform, which account for 62.97%. Development investment expenditure totaled VND 540,046 billion, an increase of VND 60,478 billion (equivalent to 12.6%) over the estimate.

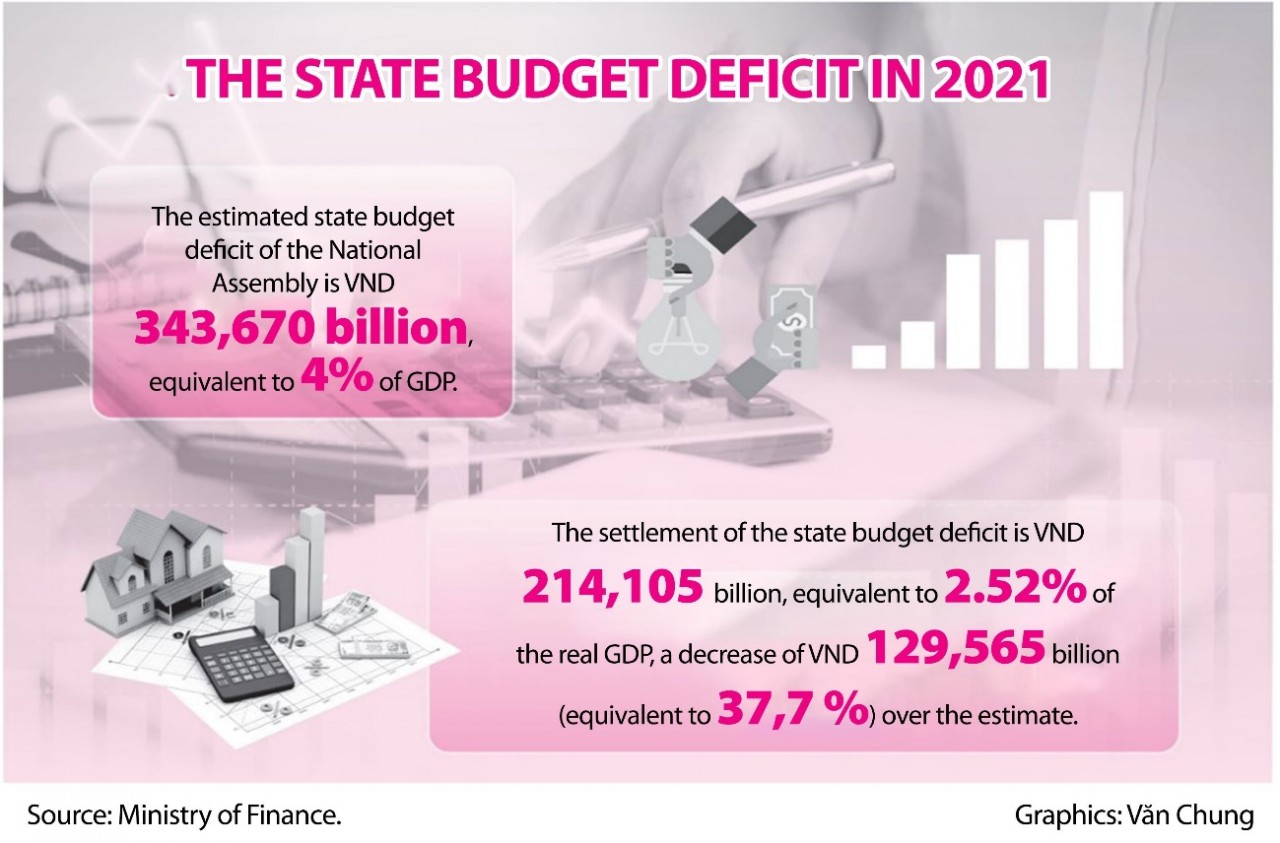

The state budget deficit estimate of the National Assembly is VND 343,670 billion, equivalent to 4% of GDP. The settlement of the state budget deficit is VND 214,105 billion, equivalent to 2.52% of the real GDP, which is 129,565 billion VND (equivalent to 37.7%) less than the estimate.

In 2021, the Government directed the synchronous and drastic implementation of various solutions, including proactive management and administration of the state budget to ensure policies and regimes, strengthen financial discipline, and improve the efficiency of state budget use. It, in particular, had a firm grasp on the case for prioritizing COVID-19 pandemic control and prevention.

Ministries and central and local authorities have seriously implemented the proposed solutions; budget expenditures closely follow the assigned targets and estimates; review and sharply cut recurrent expenditures that are not truly necessary; gradually implement, and focus resources on Covid-19 control and prevention.

However, the Government also noted that throughout the implementation, the disbursement ratio of public investment capital is still low. The implementation of several policies to ensure social security is still slow. The funds transferred to the following year are still large. Some ministries, branches, and localities have not strictly enforced the discipline of state finance in managing and using the budget, implementing the budget settlements, and sending it to the Ministry of Finance for appraisal and synthesis, which is still slow and non-compliant with regulations.

Properly assess the situation pay compliment to the right agent

In response to some issues in the reports presented at the meeting, Minister of Finance Ho Duc Phoc suggested that there should be data consistency in the reports; as well as correct assessments and proper understanding of the essence of the current situation, because if not accurately assessed, it will make the National Assembly deputies confused once presented to National Assembly.

One of the issues raised by the Minister is the assessment of debt borrowing regarding revenue progress and principal payment, debt repayment capacity, and public investment disbursement. According to the Minister, the central state budget only borrows more than VND 368 trillion domestically in 2021, saving VND 159 trillion over the National Assembly's plan. To ensure timely administration, the budget must always have funds available to meet spending needs. Even the issuance of loans does not guarantee to borrow the correct amount, so there will be insufficient resources to meet planned and unforeseen spending needs.

Regarding the assessment of budgeted fund management, the Minister also proposed dissecting the issue, clarifying the reasons for the fund's inventory, and the reasons for the failure to disburse funds, including reasons from legal policies, current regulations, and so on. Currently, there are a number of regulations causing a blockage in disbursement that need to be soon removed for smooth implementation across the country.

State Auditor General Ngo Van Tuan expressed strong agreement with the Ministry of Finance's explanation of the debt content and stated that, from a market standpoint, borrowing from the state budget is important for meeting spending needs, ensuring liquidity, and developing the capital market. The interest rate on Government bonds serves as the benchmark interest rate for the development of the capital market, ensuring the safety of lenders. Fundraising organizations shall base on Government bond interest rates to determine lending interest rates. The fundamental issue is how to effectively manage the funds raised.

Concluding the discussion, Deputy Chairman of the National Assembly Nguyen Duc Hai stated that the Standing Committee of the National Assembly highly appreciated the Government's efforts during the pandemic that seriously impacted all aspects of socioeconomic life and that policies on tax exemption and reduction, tax reduction, and policies to support businesses and people must be implemented.

Despite that context, overall budget revenue exceeded the National Assembly's estimate of 12.7%, the proportion of domestic revenue reached 82.5% of total state budget revenue, basic budget expenditures to ensure the State's tasks, the proportion of recurrent expenditures was equal to 62.97%, the state budget deficit was lower than the estimate assigned by the National Assembly, and state budget revenue and expenditure rules have gradually improved.

Highlighting these results, Vice Chairman of the National Assembly Nguyen Duc Hai said that it is essential to properly assess the current situation. When it comes to providing the National Assembly with an assessment of a budget year, it is necessary to accurately identify the situation, properly praise as well as form the correct judgment.

Furthermore, the National Assembly discovered, through the State Audit Report, the Finance and Budget Committee of the National Assembly, and the comments, that there have been shortcomings in the management, administration, and use of the budget that have not been resolved, implying that the Government requires drastic solutions to address.

| Handling collective and individual responsibilities for financial and budgetary violations Reporting on the implementation of the State Audit Office of Vietnam's (State Audit) recommendations, the Government stated that it directed ministries, and central and local authorities to handle violations, recover tax evasion, and wrong expenditures. As of March 23, 2023, VND 22,151 billion had been spent, representing 87.2% of the recommendations for the state budget to be settled in 2020. In 2021, the State Audit Office of Vietnam has 198 recommendations on document amendments, supplements, new issuances, or annulments. Ministries, central authorities, and localities have completed 23 of the 91 recommendations of the State Audit Office of Vietnam on perfecting mechanisms and policies related to the amendment, supplementation, and promulgation of new legal documents. In the meanwhile, 68 recommendations on completing mechanisms and policies related to the amendment, supplementation, and promulgation of new legal documents are being implemented Regarding handling the responsibilities of organizations and individuals with financial and budgetary violations for the State budget settlement in 2020 under the proposal of the State Audit Office of Vietnam (as of March 31, 2023), the Government reported that the total number of organizations requesting handling is 1,444, of which 1,295 organizations have been processed, accounting for 89.68%; currently processing 127 organizations, making up 8.80%; the number of unprocessed organizations is 22 organizations, equivalent to 1.52%. Individual processing requests totaled 2,735, of which 2,519 were processed (accounting for 92.1%); 200 people are currently being processed (equivalent to 7.31%); and 16 people have not been processed (making up 0.59%). |