Finance awakens and strengthens people's patriotism and strength

The financial situation was extremely difficult immediately after the success of the August Revolution in 1945, in the context that the country was still hostile to the enemy, but under the leadership of the Party and the State, in response to President Ho Chi Minh's Call for Patriotic Emulation, a series of financial measures were applied to arouse and promote the patriotism and synergy of the people, contributing to the national defense and construction.

In the early days of its establishment, with the mission of mobilizing all financial resources to meet urgent and important expenditure needs, the Party, Government, and Minister of Finance Pham Van Dong (September 1945 - March 1946) focused on building a financial policy system with the people as the root, relying on the people, serving the people while ensuring national interests, and in line with the people's interests and aspirations.

|

| People of all classes enthusiastically supported the Independence Fund and Golden Week, which were held at the Hanoi Opera House in September 1945. |

As we have entered the period of building socialism in the North and fighting for the liberation of the South, the Financial sector has encouraged patriotic emulation, gathered strength in time to adjust the tax regime, promulgate new financial policies, and increase revenue for the State budget. Financial policies demonstrate the distillation of each domestic capital and the effective use of foreign aid in the country's construction, the socialist North's protection, the highest level of human strength, and the strength of the South.

|

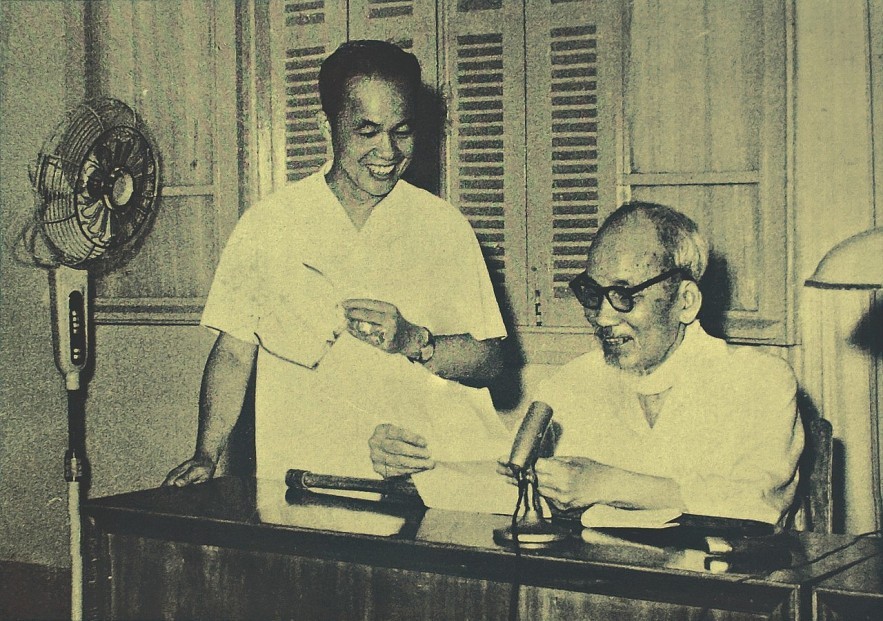

| Hoang Anh, the Minister of Finance, informed Uncle Ho of the financial work. Photo: TL |

The Financial sector focused all resources on economic recovery, overcoming the heavy consequences of war through a series of positive financial and budgetary measures such as gradually eliminating budget subsidies, ending the issuance of money for budget deficits, reforming the tax system, and managing the budget; thereby promoting economic development, contributing to improving people's lives, and maintaining national financial potential.

The entire Financial sector intently concentrated on mobilizing State capital, strictly managing and effectively using it, promoting economic development, practicing strict savings, striving to reduce deficit, and increasing budget revenue. The shift in revenue proportions between 1981 and 1985 was significant and demonstrated the success of a sustainable encouragement policy. During this time, domestic revenue increased from 60.8% to 77.5% while foreign revenue decreased from 39.2% to 22.5%.

State budget expenditures became increasingly efficient. In the period 1981 - 1985, the State budget allocated capital for accumulation by 10.5 times and for consumption by 12.9 times compared to the period 1976 - 1980. Capital construction accounted for 87.55% of accumulated expenditures and was equal to 10.63 times in the period 1976-1980.

The Financial sector was also at the forefront of policy advice for the Party and State to recognize, choose the path of innovation, economic opening, and international integration, build a socialist-oriented market economy, and implement the resolution of the 6th National Party Congress (December 1986). International economic integration was required at this time.

In a relatively short period, the Financial sector took the lead in receiving the world's elite financial management and applying it in line with the domestic economic context. Attracting FDI and ODA, encouraging the development of a multi-component commodity economy, promoting import and export activities, and increasing spending on development investment, education, health, and social security were all priorities for fiscal policies. As a result, State budget revenue steadily increased, rising 30.7 times (including price difference revenue) between 1986 and 1990 in comparison to the period of 1981-1985.

The State budget structure underwent significant qualitative changes between 1990 and 2000, both in terms of revenue and expenditure, balance, and management. The tax system has been fundamentally and completely overhauled. The State gradually granted financial enterprises autonomy, promoted equitization, and created a level playing field for all economic sectors.

Finance promotes and paves the way for the country's rapid and sustainable development

Financial integration and opening up have always been the first, most urgent, and most timely requirements, paving the way for capital flows to promote growth. The Financial sector advises the Party and the State to issue a large number of appropriate legal documents, establishing a legal framework for the development of all sectors and fields. As a consequence, it has aided in the mobilization of the entire society's resources, the lifeblood of the economy, thereby promoting and paving the way for rapid and sustainable development.

In particular, Vietnam's per capita income left the group of poor countries for the first time in 2009 (exceeding USD 1,000 /per capita/per year). After more than a decade, the expected GDP per capita in 2022 increased by 3.6 times over 2009.

The state budget revenue and expenditure structure has been improved in an increasingly positive direction over the past more than ten years (2011–2020), ensuring high stability and sustainability. The proportion of domestic revenue (excluding crude oil) grew from an average of 57.85% in 2006-2010 to 67.7% in 2011-2015.

The state budget revenue structure changed positively between 2016 and 2020, with the proportion of domestic revenue gradually increasing from 67.7% on average between 2011 and 2015 to nearly 84% in 2020.

Looking back on ten years of implementing the Financial Strategy to 2020, it can be stated that the national financial system has undergone clear changes, financial institutions - the State budget according to socialist-oriented market principles. As a result, it has supported the process of restructuring the economy and transforming the growth model, in line with the specific conditions of the country in each period and gradually approaching international practices, and the country's financial potential has been strengthened.

Financial and State budget mechanisms and policies play an active role in mobilizing all available resources for development investment. The process of restructuring and renovating state-owned enterprises (SOEs) has yielded significant results, and the operational efficiency of the SOE sector has improved. The financial market has developed steadily, and the market restructuring process has been carried out synchronously, ensuring the set progress.

Administrative reform in the Financial sector has been bolstered, yielding numerous significant and positive outcomes. The use of information technology and the modernization of the finance industry has improved. International financial integration and cooperation have been strengthened.

Finance confirms its critical role in economic rebound and development

Over the last three years, in the face of the COVID-19 pandemic's negative impacts in various aspects, financial policies have been reaffirmed as a pillar for socioeconomic development.

|

| Finance Minister Le Van Hien (front) and Prime Minister Pham Van Dong attended at the National Patriotic Emulation Congress in 1951. Photo: TL |

The COVID-19 pandemic has posed unprecedented challenges and enormous difficulties for the entire economy. In that context, the Government and the Ministry of Finance (MoF) have taken decisive and appropriate steps. In general, policies to support individuals and businesses over the last three years have included large support packages on fiscal policies (exemption, reduction, reduction of taxes, fees, charges, extension of value-added tax payment deadline, corporate income tax for small and micro enterprises, personal income tax, land rent, so on, totaling more than 400 billion VND); credit support policies such as interest rate support for businesses to develop production (credit package of 250,000 billion VND); social security policies (the two support packages of 62,000 billion VND and 26,000 billion VND respectively) and many other tax and fee policies to support the economy amidst rising raw material prices, which have caused inflation.

On March 21, 2022, the Prime Minister issued Decision No. 368/ QD-TTg approving the Financial Strategy to 2030 with the goal of building a sustainable, modern, and integrated national finance, contributing to growth, strengthening the economy's resilience, ensuring macroeconomic stability, and national financial security. This is the direction and guideline for the future development of the Financial sector.

Sustainable development of national finance

With a proud legacy of 78 years in construction and development, the MoF remains committed to building a robust national financial system that can withstand the rapid, strong, and unpredictable changes in the regional and global economy. This has enabled the achievement of socio-economic development goals and the state budget for 2023 and beyond. The Party Committee and leaders of the Ministry of Finance have closely directed the entire sector to prioritize key tasks.

In particular, it is vital to prioritize the prompt implementation of fiscal and monetary policy solutions to support the socioeconomic rebound and development program and strive to meet and exceed the set economic growth target in 2023. Furthermore, it is essential to focus on building and perfecting institutions and financial-state budget projects following the Government's work program and practical requirements, ensuring time limits, quality, and feasibility, and resolving difficulties for the production and business of the enterprise community.

In addition, it is necessary to effectively implement tax laws and State budget collection tasks in 2023 and strive to exceed the National Assembly's budget estimate; strengthen revenue management, and firmly grasp the revenue source in the area to put forward solutions suitable for each field and object of revenue collection. For 2023, it is crucial to manage state budget expenditures economically and effectively to support economic recovery, control COVID-19, and encourage public investment disbursement.

Moreover, in order to achieve sustainable development, it is essential to ensure the safe and smooth operation of the financial market and financial services. This can be done by managing prices based on market principles, controlling inflation, stabilizing large balances, and supporting economic growth. Additionally, it is important to maintain tight financial discipline and enhance inspection, examination, supervision, publicity, and transparency.

The Financial sector has a rich legacy of achievements in construction and development. It is expected that in 2023 and beyond, the sector will continue to work together to overcome challenges and successfully fulfill its financial and state budget duties. By doing so, they will carry on their glorious 78-year tradition./.