Why did the corporate bond market cool down in February?

Despite unfavorable developments of the Covid-19 pandemic on the Vietnamese economy, having a great impact on the business environment and business activities of enterprises, the corporate bond market still maintains an impressive double-digit growth rate.

According to data from FiinGroup, the average compound growth of the corporate bond market in the period 2017 - 2021 will be approximately 55%, in 2021 alone, the total issuance value will reach VND 657 trillion, excluding USD 1.43 billion of bonds mobilized in the international debt market.

The corporate bond market remained vibrant in January 2022, however, this market showed signs of cooling down in February. According to data from FiinPro, in February 2022, only VND1,800 billion of corporate bonds were issued in the domestic market.

Assessing this development, experts of KB Securities Vietnam Company (KBSV) said that the sharp decrease in the amount of corporate bonds in February may be due to the fact that businesses have not had time to adapt to the regulations on the purchase and sale of corporate bonds under the new Circular 16/2021/TT-NHNN effective from mid-January 2022.

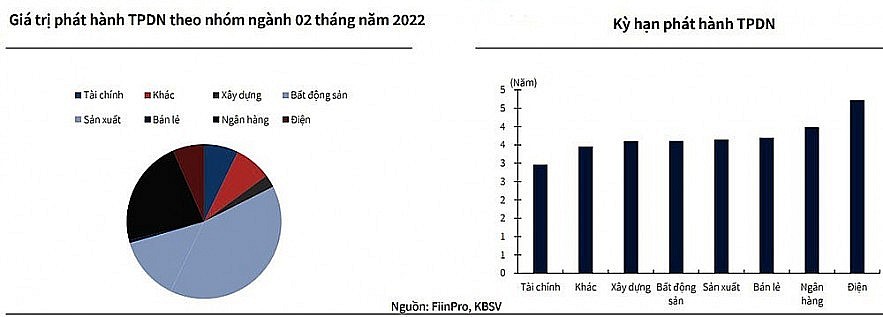

Talking to a reporter from TBTCVN, Ms. Le Hong Tam - Deputy Director of Consulting Division, Petroleum Securities Company (PSI) also said that according to FiinPro data, in February 2022, only VND 1,800 billion of corporate bonds were issued in the domestic market; However, in January 2022, VND 22,710 billion of corporate bonds were issued. In total, in the first 2 months of the year, about VND 25,894 billion of corporate bonds were issued, double the volume compared to the same period last year. In which, the real estate group accounted for the largest issuance proportion in January, while the construction and building materials industry accounted for the largest issuance proportion in February.

“It is possible to explain the partial cooling of the corporate bond market in February because Circular 16/2021/TT-NHNN took effect from January 15, 2022. This Circular directly affects the bond investment of commercial banks, which are the institutions that participate the most in the bond market. On the other hand, due to the Lunar New Year, businesses need time to restart their business activities and make financial plans for the following years," explained Ms. Le Hong Tam.

The market will be vibrant again in the near future

KBSV's experts said that the corporate bond market is forecasted to be more active in the coming months when businesses and credit institutions have a large demand for capital mobilization for production and business activities in the context of a "normalized" economy and businesses were able to adapt to the new regulations. Besides, "Corporate bond channel is still an attractive investment channel when deposit interest rates are maintained at low level" - KBSV expert said.

Ms. Le Hong Tam also emphasized: "I think the corporate bond market this year is still vibrant". PSI's expert explained, on the demand side, investors are still very interested in the market. Not only institutional investors but also individual investors, corporate bonds have become a familiar investment channel, with more attractive yields than savings at banks and the lowest risk among current investment channels. On the other hand, the supply of bonds is still abundant because the need to mobilize capital through the bond channel to serve production and business is very large, especially potential businesses that need long-term capital to recover business operations after a long delay due to the Covid-19 pandemic.

According to Ms. Le Hong Tam, Circular 16/2021/TT-NHNN and draft Decree amending Decree 153/2020/TT-BTC when issued will have stricter requirements on issuance purposes and restrict the acquisition of enterprises through the issuance of bonds, encouraging capital to invest in the right purposes of the enterprise's operation. “I think the bond market will be strict in the number of bonds issued, especially businesses in the real estate sector; However, it will create transparency for investors to participate, creating motivation for businesses with business activities such as production, trade.... Hence diversifying the type of issuer and investors have more investment options," said Ms. Le Hong Tam.