|

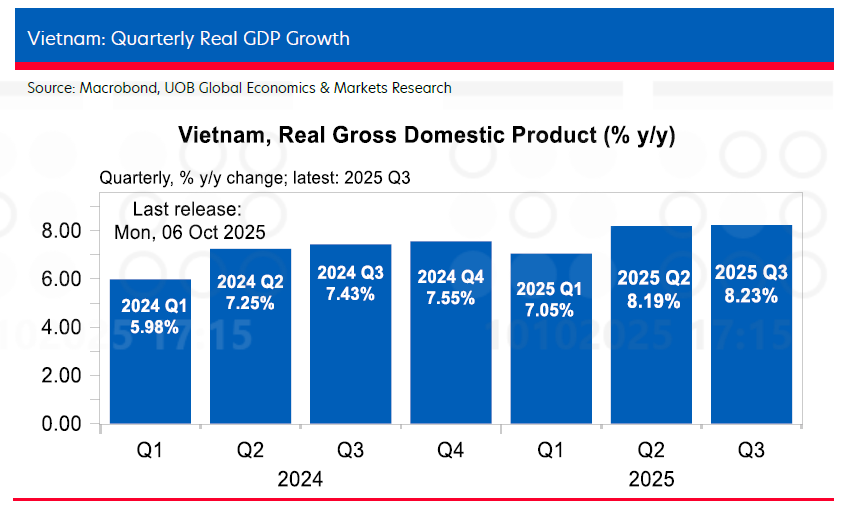

According to the National Statistics Office, Vietnam’s real GDP growth surged by 8.23 per cent on-year in the third quarter, supported by strong exports performance and production despite US tariffs. This is the strongest quarterly out-turn since the third quarter of 2022, when the economy expanded 14.4 per cent on-year.

The third quarter is a further extension of the 8.19 per cent growth pace in the second quarter (revised higher from earlier estimate of 7.96 per cent), and well ahead of Bloomberg est of 7.2 per cent and the UOB call of 7.6 per cent. In the first nine months of 2025, Vietnam’s economy expanded 7.85 per cent on-year.

UOB said in a report released on November 10 that the strong performance came largely on the back of robust external trade activities as well as manufacturing output. In the Jan-Sep period, exports surged 16 per cent on-year with exports to the US registering 27.7 per cent on-year increase, amid a backdrop of tariff rates being imposed.

Manufacturing production saw a broad-based increase in the same period, increasing 10.8 per cent on-year in Jan-Sep, a faster pace compared to the 9.4 per cent rise in the same period in 2024.

Manufacturing purchasing managers' index data expanded for the third month in Sep (above 50), reversing three months of sub-50 readings prior to that. "This suggests a stabilised outlook ahead and is further reaffirmed by the quickened pace of realised foreign direct investment inflows, which increased 8.5 per cent on-year to $18.8 billion in the first nine months of 2025," UOB reported. "If the momentum continues into the last quarter, this could mean that full-year inflows may match the record inflows of $25.4 billion achieved in 2024."

Outlook delayed US tariff impact?

US tariff uncertainty eased in the second half of the year after the US finalised country-specific rates before the August deadline. Vietnam’s rate was set at 20 per cent.

UOB said that while the tariffs are lower than the initial 46 per cent threat, concerns remain. The 40 per cent transshipment tariff lacks detail, and no further information has been provided to determine how transshipment is defined. Sector-specific rates on furniture had been announced, although no specific details have been given either.

Nonetheless, furniture accounted for about 10 per cent of US imports from Vietnam in 2024, which would be another area of concern as tariff impact bites further.

"Vietnam is particularly vulnerable to trade frictions such as US tariffs, due to the open nature of its economy: exports of goods and services account for 83 per cent of Vietnam’s GDP, the second highest in ASEAN after Singapore (182 per cent), as well as its outsized exposure to the US market," UOB highlighted.

The US accounted for 30 per cent share of Vietnam's exports of $406 billion in 2024 and was its largest market, followed by China (15 per cent) and South Korea (6 per cent). The major products sold to the US in 2024 include electrical products ($41.7 billion), mobile phones and related items ($28.8 billion), furniture ($13.2 billion), and footwear ($8.8 billion). Products from these sectors accounted for nearly 80 per cent of the shipments that Vietnam sent to the US in 2024.

UOB reported that while Vietnam’s trade activities appeared to be robust so far despite US tariffs, one potential outcome is that exports orders could start to fade once the front-loading of orders ease and higher prices affect US consumer demand, especially into 2026.

|

With an expansion of 7.85 per cent on-year achieved in the first three quarters, UOB's outlook remains positive for 2025. However, due to a high base in the last quarter of 2024, UOB anticipated the final quarter would be a challenge given a backdrop of tariffs and trade frictions.

"As such, we are keeping our fourth quarter's growth projection of 7.2 per cent on-year, which implies an upward adjustment to our full-year growth forecast of 7.7 per cent (from our previous projection of 7.5 per cent). It would be even more daunting to achieve the official 8.3-8.5 per cent projection, which would require the last quarter expansion of 9.7-10.5 per cent on-year," UOB reported.

Central bank to hold rates steady

With a robust economic performance in the first 9 months of the year and no signs of slowing in momentum, there is little room for State Bank of Vietnam (SBV) to ease policy at the moment. Meanwhile, inflation pressures remain present, with inflation rate of 3.38 per cent on-year in September from 3.24 per cent in August, inflation rate averaged 3.3 per cent (overall) and 3.2 per cent (core), with the latter outpacing the rate in 2024 (2.9 per cent) and 2023 (3 per cent).

The foreign exchange market is likely another key consideration for the SBV. The VND remained the second worst performing Asian currency in the first nine months of 2025, declining by 3.55 per cent against the USD, ahead of Indian rupee’s 3.58 per cent fall and trailing marginally behind Indonesia rupiah’s 3.38 per cent drop.

In contrast, regional peers benefitted from a broad USD weakness backdrop, with gains ranging from 7.65 per cent for the Taiwan dollar to 2.5 per cent for the Chinese Renmimbi during this period.

UOB continued to be negative on the VND, which stayed close to its record low of 26,436/USD reached in August, as the SBV continued to guide the currency weaker through its daily fixings. Given the limited correlation between USD/VND and the broader DXY, UOB expected the VND to lag regional peers in benefiting from renewed USD softness, which is likely to emerge as the US Fed proceeds with further rate cuts.

"Overall, we maintain a cautious outlook on the VND and revise our USD/VND forecasts to 26,400 in the last quarter, 26,300 in the first quarter of 2026, 26,200 in Q2, and 26,100 in Q3," UOB forecasted.