The initiative signals a strategic move by Cake to expand beyond domestic digital banking services and pioneer a new category of cross-border financial solutions led by a Vietnamese digital bank. As cross-border e-commerce accelerates across Southeast Asia, Cake aims to position itself at the forefront of enabling seamless inbound international payment flows for individual sellers and small businesses.

|

The global cross-border e-commerce market was valued at $791.5 billion in 2024 and is projected to grow at an annual rate exceeding 30 per cent through 2031, according to Cognitive Market Research. Southeast Asia remains one of the fastest-growing digital economies, with Vietnam emerging as a key player.

Under Vietnam’s National Master Plan for E-Commerce Development for 2026–2030, cross-border e-commerce has been identified as a strategic pillar to strengthen the country’s digital ecosystem and global competitiveness.

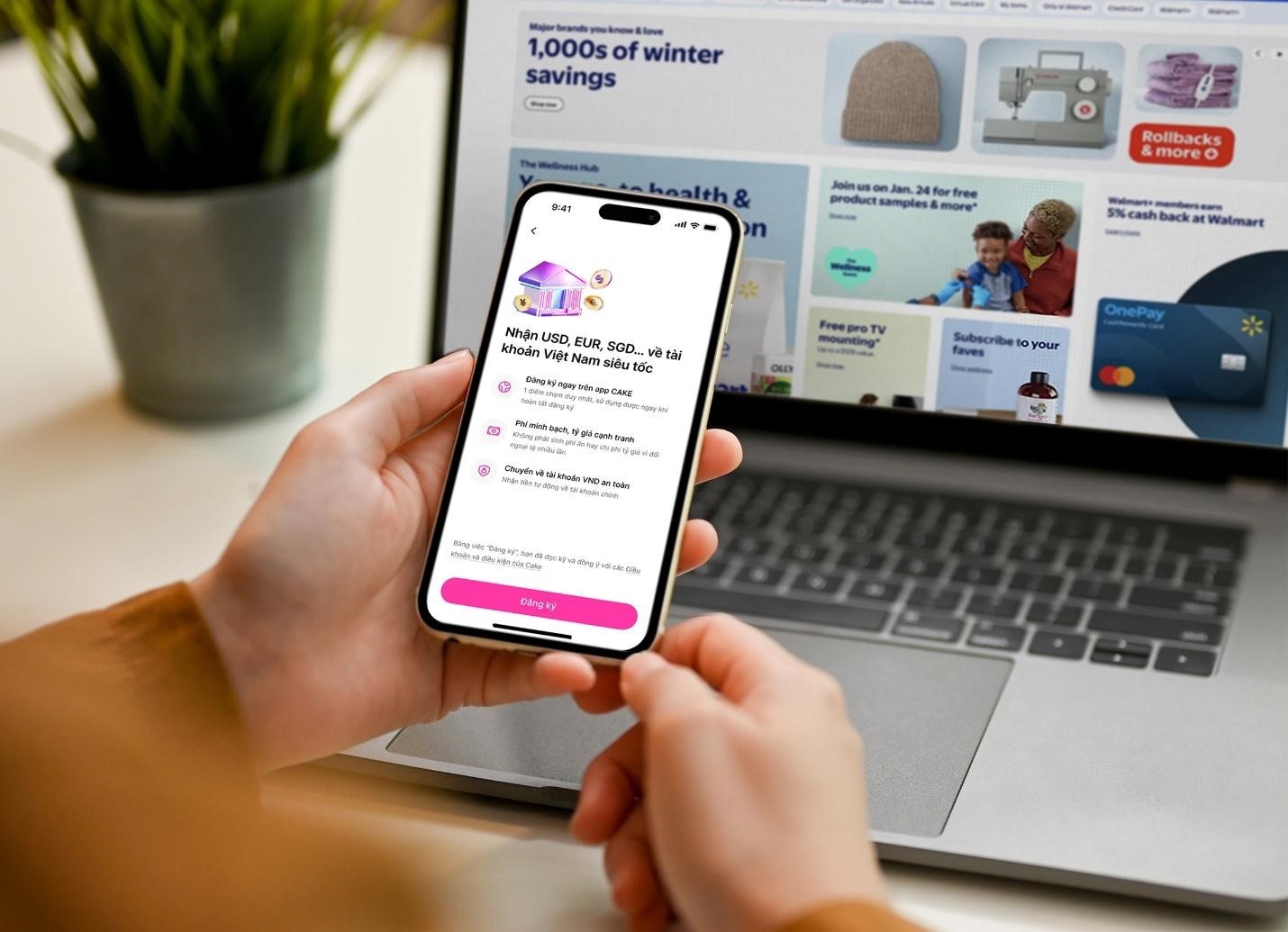

The number of Vietnamese individuals and SMEs operating on international platforms such as Amazon, eBay, and Etsy continues to rise. However, managing overseas revenue remains a major bottleneck. Sellers typically depend on foreign payment intermediaries, facing complex onboarding procedures, extended settlement timelines, and opaque fees.

A bank-led approach to cross-border receivables

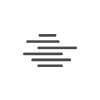

Recognising this gap, Cake is developing Cake GlobalX as a fully digital, bank-integrated solution that will allow users to receive income from overseas markets directly into their Cake accounts, offering an alternative to conventional models that rely heavily on third-party intermediaries.

Cake GlobalX is designed to enable users to track incoming funds, manage revenues, and convert foreign currency into VND within a single digital banking platform. With a fully digitised workflow, transparent pricing, and streamlined processing, the solution aims to make receiving money from abroad as seamless as a standard domestic transaction.

This move represents a pioneering step by Cake by VPBank in simplifying cross-border receivables, which continue to face procedural complexity, extended settlement timelines, and cost inefficiencies in the Vietnamese market. Under the planned model, sellers will only need to open a Cake digital banking account and register for Cake GlobalX through a fully online process expected to take just minutes.

All inbound international transactions will be trackable directly within the Cake app. Users will be able to convert funds into VND at transparent exchange rates quoted by VPBank and receive same-day settlement, significantly improving cash flow efficiency compared to traditional cross-border processes.

By embedding cross-border receivables into its digital banking ecosystem, Cake is positioning itself as one of the first digital banks in Vietnam to actively develop this service category, moving beyond basic domestic financial services toward enabling global cash flow connectivity.

|

Cake GlobalX reflects Cake’s broader strategy of simplifying complex financial services through technology. The onboarding process is being designed to be fully digital, allowing users to open an account and register for the service seamlessly via the Cake app. Once operational, users will be provided with dedicated payment credentials that can be linked directly to their seller accounts on international e-commerce platforms.

All inbound transactions will be trackable in real time within the app, enhancing transparency and giving users greater control over cross-border financial management.

Nguyen Huu Quang, CEO of Cake by VPBank, said, “The rapid expansion of cross-border e-commerce is creating new demands for financial services in Vietnam. With Cake GlobalX, we are building a technology-driven solution that simplifies international receivables and empowers Vietnamese entrepreneurs to access global cash flows more efficiently. This is a strategic step in our journey to develop a comprehensive digital banking ecosystem that supports both domestic and cross-border financial needs.”

To build a robust and internationally compliant infrastructure, Cake is partnering with Visa to leverage its global payment network and technological capabilities.

During the development phase, Visa is supporting Cake in establishing a secure and scalable framework for inbound cross-border transactions, ensuring alignment with global standards while tailoring the solution to the Vietnamese market.

Dang Tuyet Dung, country manager of Visa Vietnam and Laos, said, “We value Cake by VPBank’s forward-looking approach in anticipating the growing demand for cross-border receivables in Vietnam. Our collaboration underscores Visa’s commitment to working with innovative digital banks to expand secure and seamless global payment connectivity for local entrepreneurs and businesses.”

The development of Cake GlobalX highlights Cake’s ambition to move beyond traditional digital banking features and play a pioneering role in shaping Vietnam’s cross-border financial infrastructure.

As demand for international income flows continues to rise in Vietnam and across Southeast Asia, Cake expects to officially introduce Cake GlobalX to the market in the first quarter of 2026, marking a significant milestone in its evolution toward internationally oriented digital financial services.