|

| Photo: Shutterstock |

According to Deloitte's Southeast Asia IPO Capital Market 2025 report on January 27, IPO capital markets across Southeast Asia produced 120 IPOs which raised $6.5 billion in funds and $33.3 billion in market capitalisation in 2025.

As compared to 2024, there was a 76 per cent increase in the total IPO funds raised and a 74 per cent increase in total IPO market capitalisation, despite an overall drop in count from 136 in 2024 to 120 in 2025.

The average deal size doubled compared to 2024, rising from about $27 million to $54 million, supported by a few larger blockbuster IPOs. There were four offerings which raised more than $500 million from Singapore, Vietnam and the Philippines, and 14 with market capitalisation exceeding $1 billion.

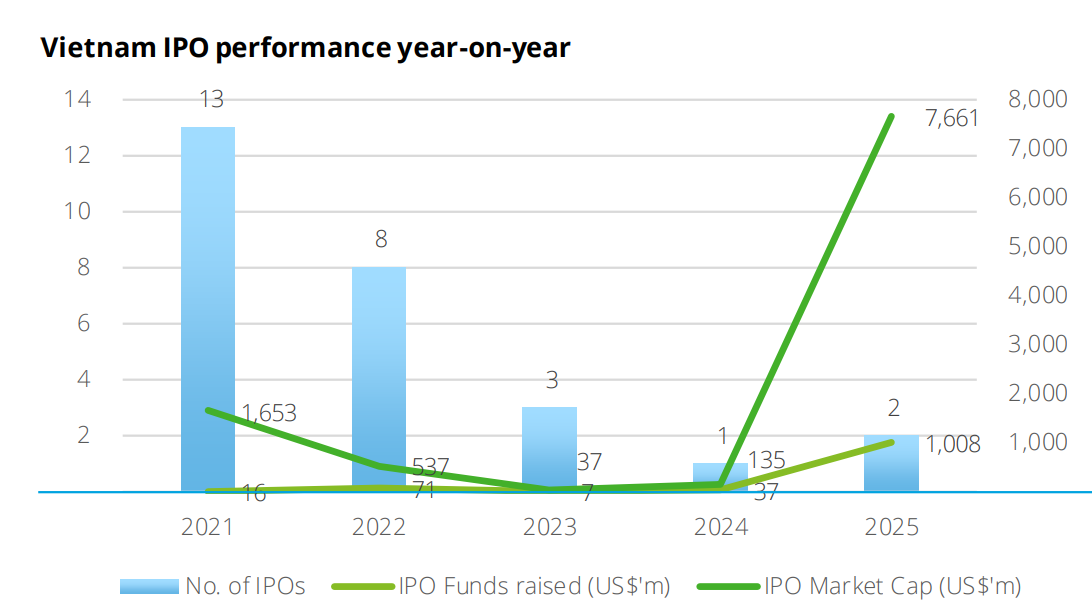

The report highlighted Vietnam’s market, despite its low volume, is among the top 3 in the region in terms of IPO amount raised and market capitalisation.

The financial services sector saw two blockbuster IPOs from Vietnam in 2025, involving Techcom Securities and VPBank Securities. They raised a collective $1 billion, which is 27x higher than 2024.

Similarly, its market capitalisation of $7.7 billion is 57x higher than 2024. This paves the way for a new growth cycle for Vietnam’s IPO market after years of stagnation since 2018.

|

| Source: Deloitte |

"Despite geopolitical and macroeconomic uncertainties, the regional market has been resilient, underpinned by regulatory reforms, sector diversification, and growing investor confidence," said Tay Hwee Ling, Capital Markets Services leader of Deloitte Southeast Asia.

"This robust environment indicates that Southeast Asia remains an attractive region for public market capital raising in 2025 and beyond. As market conditions improve, IPO aspirants will continue to keep a close watch on the capital markets for the right moment to maximise valuations and to capture pent-up demand for liquidity events that will enable investors and shareholders to unlock value," Ling added.